Speed and Greed, or: What Gets Measured Gets Done

I would like to talk about a topic that is very close to my heart, and is, in my opinion, very often depressed in the boardrooms – “street smart leadership”. Or, how my father would put it, “idiots will always find a way to make things complicated”. Is it then the burden of responsibility or the lack of the same that compel managers to make seemingly irrational decisions? I would argue it is the combination of both as their behavior is governed by the two most pragmatic things - money and recognition.

Who is the owner?

Have you pondered many times why this or that decision of an executive of a renowned company does not make any (rational) sense? And why it is that nobody objected it either ex-ante or ex-post? The reason, in my opinion, lies in the widely dispersed “ownership” of those corporations. Who are those managers accountable to? A major company may be owned by hundreds, thousands or even over a million people.

Given current global market and percentages of households that have invested in the capital markets, the odds are, you might be one of them -a less or more satisfied owner of such a company. If things are great, you´re getting your dividends and seeing the share price rise. If things go wrong, you can either wait and hope for things to get better (the company executives will run the company smarter, the markets will not be so difficult to compete at, etc.) or you can sell the shares you own. Alternatively, you can express your dissatisfaction during the Shareholders meeting. Indeed, you can be brave, but unless you own a significant stake (a blocking minority), you will not be able to influence much if anything at all. So, what then governs the decisions made by those on the top?

Who sets the targets and what are they?

In the article, "Outline of the U.S. Economy" by Conte and Carr, the authors argue that “Widely dispersed ownership also implies a separation of ownership and control. …. Because shareholders generally cannot know and manage the full details of a corporation's business, they elect a board of directors to make broad corporate policy”. Of course, operational management of a company is entrusted to the most senior managers nominated by and reporting to those supervising bodies on a company´s strategy and strategic decisions. Research by the US Department of state tells us that, typically, even members of a corporation's board of directors (or supervisory board) and managers own less than 5 percent of the common stock.

Nevertheless, those are the people who are also tasked with target setting for the company (and themselves). These targets are then cascaded down to several layers of management and finally also to individual employees. It is a rule that the achievement of targets brings along nice bonuses. Generally, the more senior the manager the larger proportion of his or her yearly compensation is represented by the bonus. I don´t want to question an undisputable right of any company owner to set targets but I do want to point out the fact that seldom, if ever, the targets are related to performance that goes beyond twelve months.

When inquiring about this practice in my past corporate life, I´ve always received the same answer: “Because this is what the shareholders want and the top executives are used to.” Who would care for a task that takes longer than a year to achieve? I am not aware that any minority shareholder or a company customer has been consulted about that practice.

What are the consequences?

With globalization, the Internet and the consequent speed of information along with its´ accessibility, we are bombarded with news, advertisements and a myriad of advice by self-proclaimed experts. Consequently, as customers, we become more demanding (or so we think) and fickle (a proxy for our lack of ability to be demanding).

Therefore, it would be logical for corporations to strive to retain good customers and good employees. But do the targets given to company executives guide them to do so? Well, from my boardroom experience, seldom, if at all. Why is it then? I don’t have a comprehensive answer to this but will use two examples to illustrate the situation.

First, let’s explore the retention of good customers, or the ones who are profitable. In 2006 report, Bain & Company reported that (i) over a 5 year period businesses may lose as many as 1/2 of their customers, (ii) acquiring a new customer can cost 6 to 7 times more than retaining an existing customer, and (iii) businesses which boosted customer retention rates by as little as 5% saw increases in their profits ranging from 5% to a whopping 95%. So why is retaining profitable customers given less attention and resources compared to obtaining new ones?

Furthermore, there are additional costs related to the promotion of new vs. existing profitable customers. In the attempt to lure in new customers, companies are offering considerably better conditions to new customers as compared to the conditions offered to existing ones. That makes many customers leave with bitter memories often causing bad PR for the company.

The case of good (value-enhancing) employee retention is not much different. Why are companies willing to pay above the market price for a new hire while they hesitate to increase a comparable employee’s compensation until he or she specifically asks for it, or, in the worst case threaten to leave or, actually leave. Again, the cost of losing a good employee can be, in relationship-driven businesses, multiplied by a cost of losing customers that are attached to the leaving employee.

Perhaps the reason is in what I was already told – “because this is what the top executives are used to.”

Looking at the bright side

The long-term plan of the Chinese government was ridiculed by many when announced in 2007. Since then China has been implementing its 100 year plan. It is buying and doing deals when others fearfully run away.

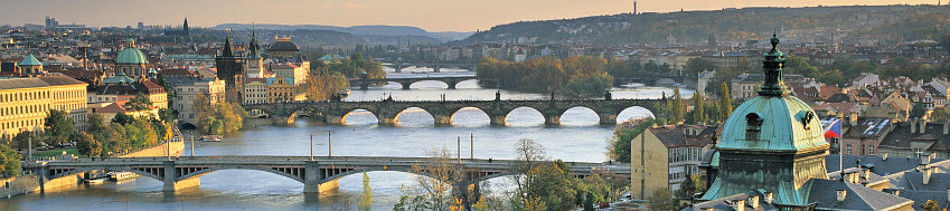

Although long-term planning was discredited by the famous ridiculously detailed long-term communist planning in my home country (extreme cases like shortage of toilet paper during the 80s still make good beer conversation topic in the former Czechoslovakia), non-intrusive, strategic planning is gaining in popularity also in a cradle of capitalism, the USA. There, Warren Buffet is walking the long-term strategy talk, advocating it in his famous quotes “In the short term the market is a popularity contest; in the long term it is a weighing machine” and “Someone's sitting in the shade today because someone planted a tree a long time ago”.

Those corporations with long-term goals that are developed, supported and evaluated by owners and managers alike are likely to sustain fashion fads in management practices and be there in a long run.

At the end of the day, what gets measured and compensated gets done.